Last week, the European Central Bank (ECB) chose to cut interest rates by 0.25% to 3.75%. The bank’s move marked a divergence from the US Federal Reserve (Fed), which is maintaining high interest rates in the face of stubborn inflation. With the ECB being the first major central bank to cut interest rates, are others likely to follow, and what does this mean for markets? Read more in this week’s State of Play.

Who’s next?

The Bank of England (BoE)

With the UK general election taking place on 4 July, the BoE is likely to keep interest rates unchanged when they meet next week. Charles Goodhart, a former member of the BoE’s Monetary Policy Committee, said: ‘Central banks don’t want to appear to be playing politics at all, so the easiest thing is to do nothing.’1

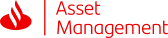

The prospect of a pre-election interest rate cut by the Bank of England has also been damaged by official figures showing no progress in bringing down the pace of wage growth.2 The UK is currently experiencing wage growth stickiness, where wage growth struggles to decline. The latest data from the Office for National Statistics showed that total pay, including bonuses, grew 5.9% in the three months to April and was higher than economists had predicted.3 Real pay, which takes into account the impact of inflation, increased 2.7% from February to April, which was in part due to the 9.8% National Living Wage increase.3 While this is good news for UK workers, the figures are well above the current inflation rate and the Monetary Policy Committee at the BoE will want to see evidence of this falling before cutting interest rates.

Wages have grown faster than inflation since June 2023

Although wage growth is a problem for the BoE, the market consensus for the first UK interest rate cut is during the BoE’s August meeting.

The US Federal Reserve

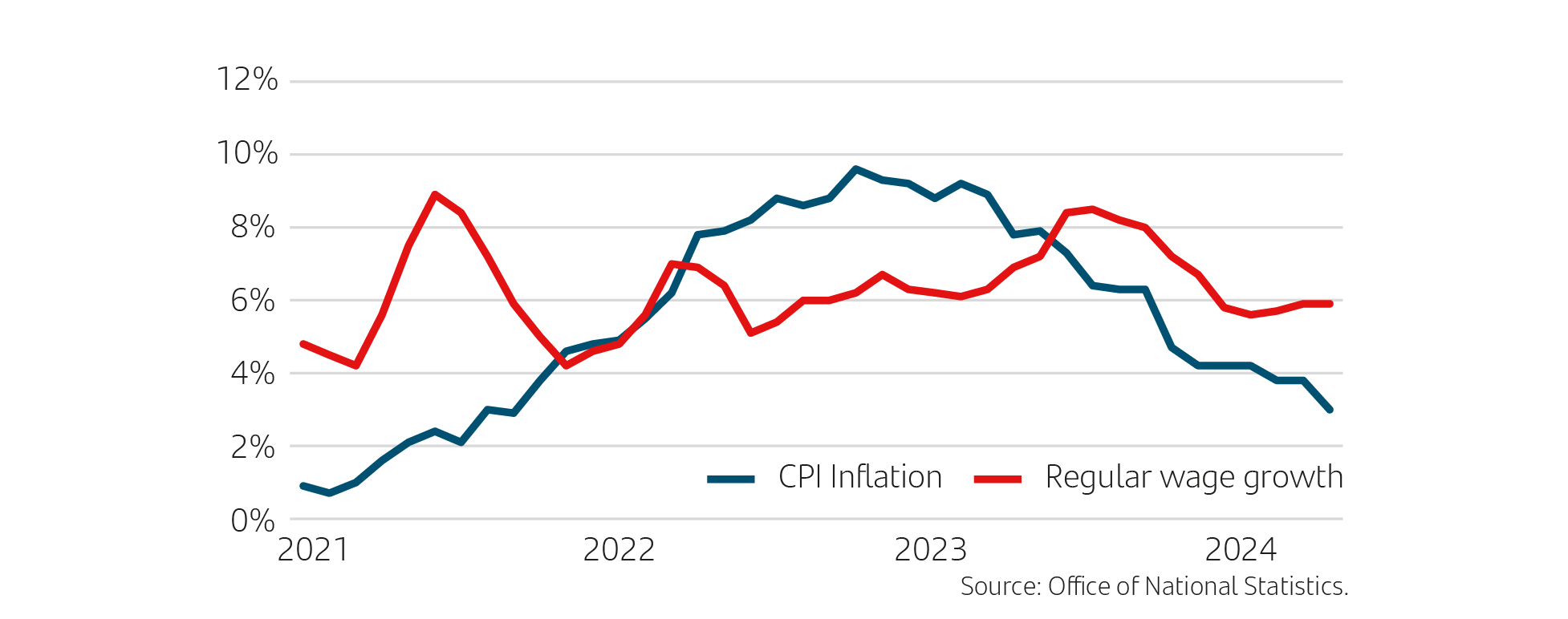

Over the pond, the US is having a tougher time tackling inflation when compared to Europe. Expectations that rates will remain higher for longer follow months of stickier-than-expected inflation as a result of strong economic growth. Economists forecasted that inflation would stay the same at 3.4% for May, however, the official data came in slightly better than expected and fell to 3.3%. 4

This level of inflation is still well above the Fed’s target level of 2%. Hence, the Fed came to the decision yesterday to hold the interest rate between 5.25% and 5.5%.

The last yards are the hardest. US Consumer Price Index, 12-month percentage change

Although the Fed is remaining cautious on taming inflation, there is optimism in the market that the first interest cut could take place in September or November.

Soft landing

When a central bank is concerned about inflation, it usually raises interest rates to slow the pace of economic growth. If the central bank raises interest rates too much then this can slow economic growth and may even lead to a recession – known as a hard landing. However, if the central bank raises rates just enough to slow the economy and reduce inflation without causing a recession, it has achieved what is known as a soft landing.5

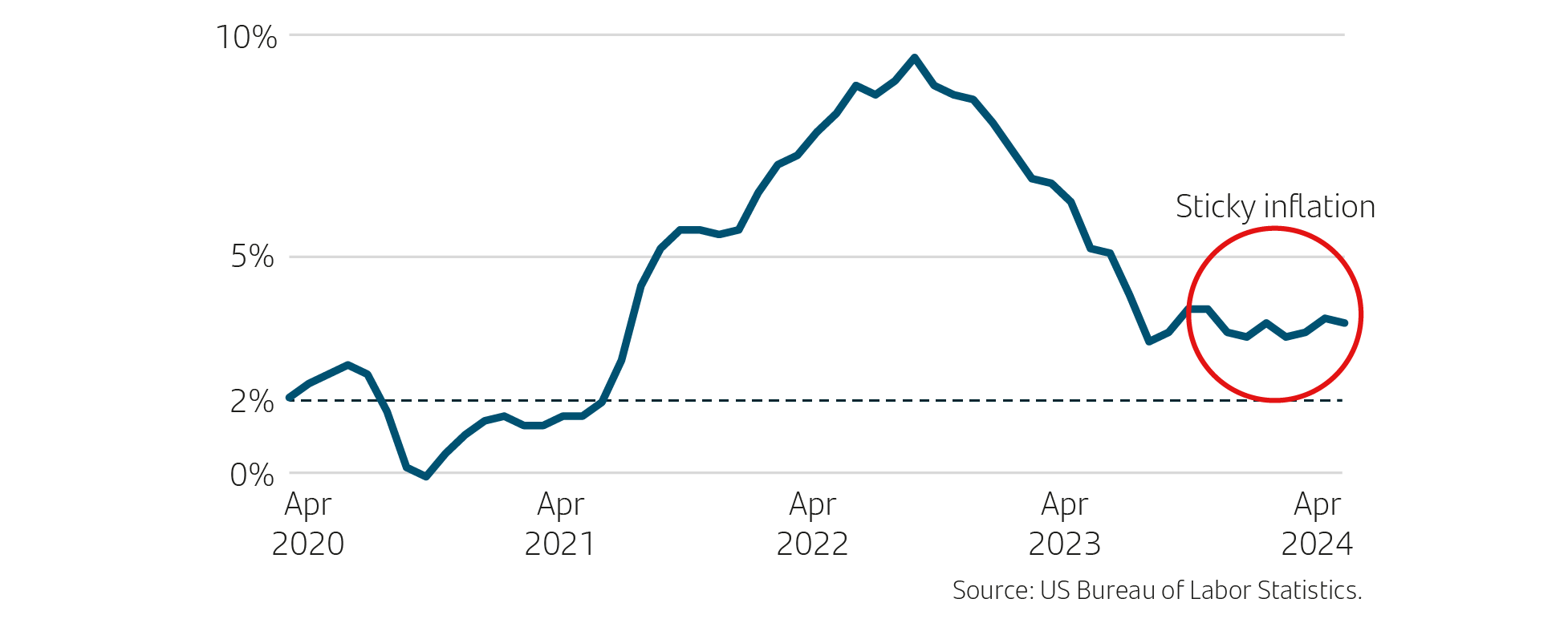

If central banks are easing policy in response to an economic downturn, the subsequent market performance is less good for shares but a little better for bonds. When rates are cut because the battle with inflation has been won without the need to push the economy into recession – a soft landing – the results favour shares.5

The UK and Europe entered into a mild technical recession at the end of 2023, although in both geographies, technical recessions have now officially come to an end and economic growth is forecast to be low and steady. The US has seen strong economic growth despite high interest rates and this growth is forecast to continue. The ECB was the first to cut rates, and with the BoE and Fed set to follow in the coming months, it looks like they could all achieve the soft landing all central banks wish for. They are the equivalent of ‘Goldilocks’ porridge’ for central bankers: following a tightening, the economy is just right – neither too hot (inflationary) nor too cold (in a recession).5

Performance after rate cuts, based on the four previous interest rate cycles

Source: Yahoo Finance, Federal Reserve, NAREIT 9 April 2024. The S&P 500 total return index was used to track performance of shares. The ICE Corporate Bonds total return index was used to track the performance of bonds. Calculations are based on the previous four rate cut cycles (2019-2020, 2007-2008, 2000-2003, 1989-1992). It is not possible to invest directly in an index. Past performance is not indicative of future results.

The value of seeking guidance and advice

It is important to seek advice and guidance from a professional financial adviser who can help to explain how to build an appropriate financial plan to match your time horizons, financial ambitions and risk comfort. If you already have a plan in place or have already invested, it is important to allocate time to review this to ensure this remains on track and appropriate for your needs.

Investing can feel complex and overwhelming, but our educational insights can help you cut through the noise. Learn more about the Principles of Investing here.

Note: Data as at 13 June 2024. 1Financial Times, 10 June 2024, 2Sky News, 11 June 2024,3Office for National Statistics, 11 June 2024, 4U.S Bureau of Labor Statistics, 12 June 2024,5Brookings, 19 December 2023.

Important information

For retail distribution.

This document has been approved and issued by Santander Asset Management UK Limited (SAM UK). This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Opinions expressed within this document, if any, are current opinions as of the date stated and do not constitute investment or any other advice; the views are subject to change and do not necessarily reflect the views of Santander Asset Management as a whole or any part thereof. While we try and take every care over the information in this document, we cannot accept any responsibility for mistakes and missing information that may be presented.

The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Past performance is not a guide to future performance.

All information is sourced, issued, and approved by Santander Asset Management UK Limited (Company Registration No. SC106669). Registered in Scotland at 287 St Vincent Street, Glasgow G2 5NB, United Kingdom. Authorised and regulated by the FCA. FCA registered number 122491. You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/register.

Santander and the flame logo are registered trademarks.www.santanderassetmanagement.co.uk