In the first iteration of Back on Track earlier this year, State of Play considered the performance of financial markets in the final months of 2023 and early 2024. After a difficult economic climate in 2022 that persisted for large parts of 2023, markets began to pick up, with US shares performing particularly well. We said in the previous issue that 2024 will probably not turn out as expected, which was certainly true. However, investors in diversified portfolios have continued to benefit from solid market returns. Santander Asset Management dives deeper into this year’s financial markets in this week’s State of Play.

2024 – Shares delivered

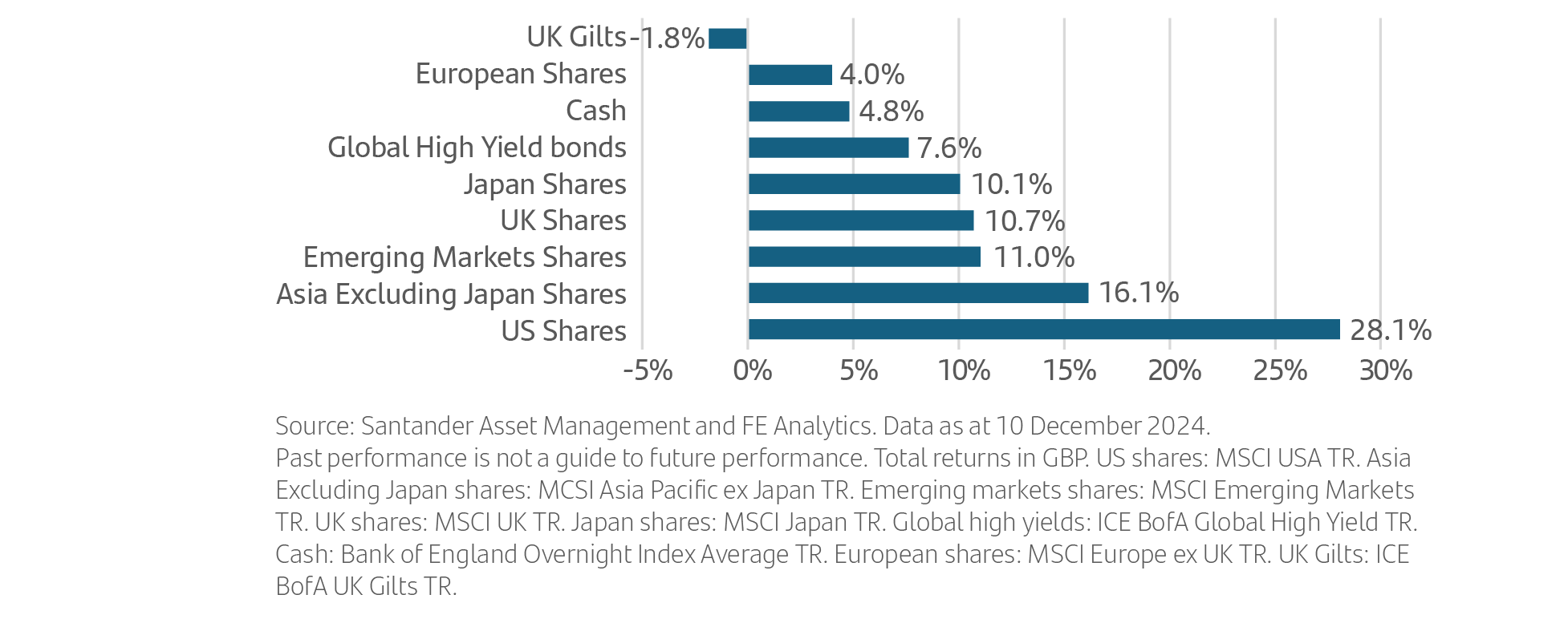

Investors were rewarded for taking on risk during 2024, as shares and particularly US shares posted the strongest returns. Bond market returns have been fairly flat, however, their outlook over the long-term is starting to look more promising.

Market returns, YTD1 (in GBP)

Although bonds struggled to outperform in comparison to shares, investors in diversified portfolios have been rewarded for taking on more risk and they are likely to have beaten the cash alternative.

What’s expecting in 2025?

As we look ahead to 2025, the global economic landscape is expected to present a more balanced environment characterised by steady growth, manageable inflation, and evolving monetary policies across different countries. Our analysis suggests that the global economy will continue to grow, with a projected GDP growth rate of around 3% for the fourth consecutive year. This positive outlook is supported by the International Monetary Fund (IMF), which anticipates growth in all regions.

In this context, we see US shares as a key investment opportunity. With company earnings expected to rise above historical averages, the US market is poised to be a significant performance driver. The technology sector, particularly companies leveraging artificial intelligence (AI), is likely to thrive, contributing to overall market growth and broadening investment opportunities.

Regarding bonds, we anticipate a favourable outlook for both sovereign and corporate bonds in 2025. Current yields appear attractive, and as central banks continue to normalise monetary policy, we expect a gradual decline in interest rates. This environment will be supportive to long-term bonds, particularly in the US, where the yield curve is expected to steepen. Investment-grade corporate bonds also present an appealing risk-return profile, with solid fundamentals and strong investor demand likely to drive performance.

Our market outlook for the UK presents a cautiously optimistic picture. The UK economy is expected to experience moderate growth, driven by a combination of stable consumer spending and a gradual recovery in business investment. With inflation projected to ease, the Bank of England is likely to continue its path of lowering interest rates, which should support economic stability.

UK stocks are positioned to benefit from a resilient economy. Sectors such as technology, healthcare, and renewable energy are anticipated to lead the way, driven by innovation and a shift towards sustainability.

The UK bond market also looks promising, with yields on UK government bonds offering the potential for attractive returns. As inflation moderates and interest rates stabilise, investors may find value in both sovereign and corporate bonds. Investment-grade corporate bonds, in particular, could perform well, supported by strong fundamentals and a favourable economic backdrop.

Diversification will be key for investors looking to navigate potential challenges while capitalising on growth prospects. As we move further into 2025, staying informed and strategically positioning portfolios will be essential to making the most of the evolving market landscape.

Market Update

In the US, major indexes like the Nasdaq and the S&P 500 climbed to record highs last week, driven by growth stocks, while value sectors like energy lagged. The Friday release of non-farm payroll data showed a rebound, with stronger-than-expected job growth. Treasury yields dropped, reflecting positive sentiment ahead of the Federal Reserve's December meeting.

In the UK, the FTSE 100 rose modestly, with cautious optimism surrounding potential rate cuts from the Bank of England next year. Mixed economic data and subdued industrial output in Germany also influenced European market dynamics.1

The value of seeking guidance and advice

It is important to seek advice and guidance from a professional financial adviser who can help to explain how to build an appropriate financial plan to match your time horizons, financial ambitions and risk comfort. If you already have a plan in place or have already invested, it is important to allocate time to review this to ensure this remains on track and appropriate for your needs.

Investing can feel complex and overwhelming, but our educational insights can help you cut through the noise. Learn more about the Principles of Investing here.

Note: Data as at 12 December 2024. 1T.Rowe Price, 9 December 2024

Important information

For retail distribution.

This document has been approved and issued by Santander Asset Management UK Limited (SAM UK). This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Opinions expressed within this document, if any, are current opinions as of the date stated and do not constitute investment or any other advice; the views are subject to change and do not necessarily reflect the views of Santander Asset Management as a whole or any part thereof. While we try and take every care over the information in this document, we cannot accept any responsibility for mistakes and missing information that may be presented.

The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Past performance is not a guide to future performance.

All information is sourced, issued, and approved by Santander Asset Management UK Limited (Company Registration No. SC106669). Registered in Scotland at 287 St Vincent Street, Glasgow G2 5NB, United Kingdom. Authorised and regulated by the FCA. FCA registered number 122491. You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/register.

Santander and the flame logo are registered trademarks.www.santanderassetmanagement.co.uk