As we approach potentially the most important round of central bank meetings to decide the future of interest rates, who are these important and powerful policymakers? Why do commentators often refer to them as either a hawk or a dove? This week we explore why central bank leaders can have such a profound influence on our financial world, not only today, but many years into our future. Our Senior Investment Specialist, Simon Durling, shares his thoughts in this week’s State of Play.

Key highlights from this week’s State of Play

- Hawk or dove?

- Federal Reserve (Fed) Chair

- Monetary Policy Committee

- Factors swaying future decisions

Hawk or dove?

Central bank policymakers, who are members of the various monetary committees around the world, are often described as being a dove or a hawk depending on their opinion on how to navigate monetary policy. Firstly, it is important to remind ourselves of the primary purpose of central banks, which is to maintain stable prices and full employment to enable stable economic growth. They are responsible for the setting of interest rates and controlling how much money is in the economy when guiding an economy to maintain rising prices around a long-term target of 2%.1

When a policymaker is described as a dove, it is because of their belief that lower interest rates and an increase in the money supply leads to higher economic growth and more jobs, even if this means inflation remains at times above the ideal target. Hawks prefer to limit inflation as their primary goal, believing that maintaining lower price rises helps deliver more sustainable economic growth in the long-term, and are prepared to increase interest rates and restrict money supply to achieve this. Whilst most policymakers tend to be either-or, there are some who follow a middle path and are referred to as centrists.2

Importantly, central banks will normally ensure the experts tasked with making such important decisions on monetary policy are a mixed group so a strong debate can underpin the decisions they make each time they meet. Also, depending on where in the economic cycle the economy reaches, hawks can become more dovish and vice versa.

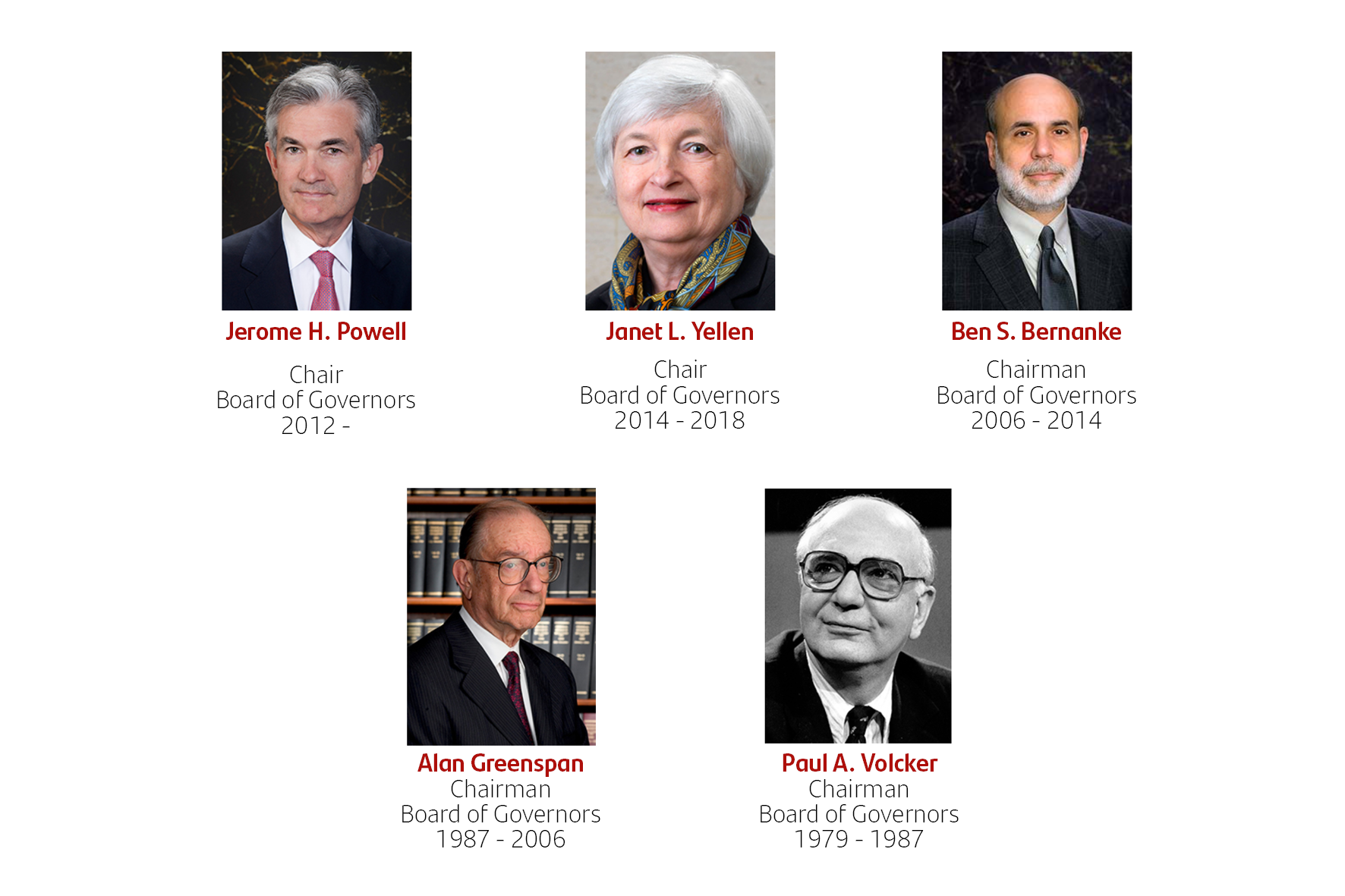

Famous Federal Reserve Chair

Over the last 50 years, the importance and profile of the central bank leaders have risen to the extent that they have become celebrities. Paul Volcker, the Fed's Chairman from 1979 to 1987, was a well-known hawk. He took charge at the end of a very economically challenging period during the 1970s, with high inflation damaging growth and jobs.3

He focused on making significant changes to the way monetary policy was adopted, explaining to the public that supply and demand forces in the market triggered higher prices and not the actions of the policymakers. During his tenure, he concentrated on structural reform, expanding the money supply without exacerbating inflation, which he successfully achieved as the Consumer Price Index fell from above 10% when he took charge to half that at the time he left office.

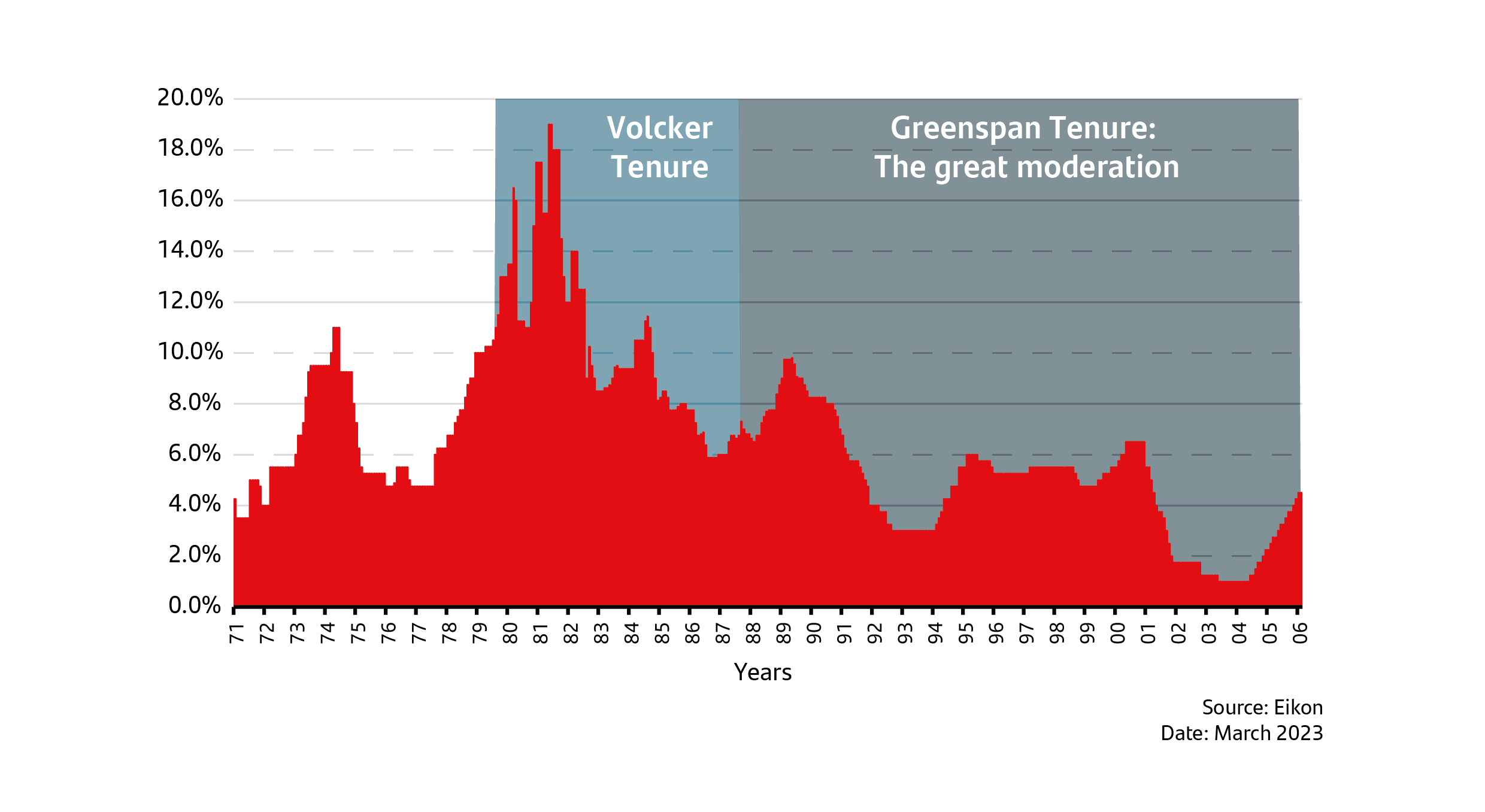

US Consumer Price Index Inflation

Arguably the most famous of all Fed Chairs was Alan Greenspan, who during his 19 years as Chair oversaw what became known as the ‘great moderation’, as inflation remained much lower and stable during his tenure (See chart above). He took office on 11 August 1987 and served under four different Presidents until 2006. He will probably be remembered for being a hawk as he prioritised controlling price inflation over full employment. He faced the October 1987 crash shortly after commencing the role, two US recessions and the September 11 terrorist attacks. Many credit Greenspan with overseeing the longest official economic expansion in US history.3

Bank of England Monetary Policy Committee

The Bank of England, like most other central banks, has a Monetary Policy Committee (MPC), which meets eight times a year (roughly six weeks apart) to decide on interest rates and other monetary decisions like the supply of money in the financial system.4 The Federal Reserve also meets eight times a year, but unlike the MPC, which has nine members who vote, the Federal Open Market Committee (FOMC) consists of twelve members. This comprises of the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis.3

If you follow both the meeting outcomes, the published minutes from each meeting, and the subsequent interviews conducted by different members of the MPC, you will notice they do not always agree on whether to increase interest rates or by how much. This is important because each member assesses the same economic data but often arrives at slightly different conclusions. This is a reflection on their expert opinion on the best way to manage monetary policy to achieve the committee’s objectives on inflation, employment, and economic growth. Their views are typically described as either more dovish or more hawkish as a result. A healthy mix of both is considered a more consistent approach to decision making.

Factors affecting future decisions by central banks

Market sentiment and pricing of future events is normally a complex mixture of economic data, changes in company earnings and other sectorial influences. Clearly, the final decisions made by central banks carry a huge weight on how investors react following their announcements. However, it is as much about what they say (or document in the minutes) than what they do.

Last week, the Governor of the Bank of England, Andrew Bailey, was indecisive when talking to financial journalists about the likelihood of further rate rises, as evidenced in the subsequent press stories about what he said. One newspaper headline interpreted what he said as an indication that rates were likely to pause, while another said that rates would need to go higher. Mark Carney, Andrew Bailey’s predecessor, introduced the policy called ‘forward guidance’. The principle was built on better communication from the Bank of England to investors on what to expect in the future. This policy, which is still practiced today, lost credibility as the parameters set for future changes in interest rates came and went without the reaction promised by the former Governor. The Treasury Select Committee nicknamed the MPC as the unreliable boyfriend as a result.

Central bank policymakers have difficult decisions to make. They must balance the need to bring down inflation whilst providing opportunity for economies to grow and for people to be able to find appropriate employment. At present, the challenge facing all central banks is that inflation remains more stubborn than expected just a few months ago. Whilst energy prices have fallen significantly, food price inflation is in double digits and the employment market remains very tight. This simply reflects that there are a high number of vacancies and unemployment is near record lows. As a result, wage settlements remain high when compared to the long-run average, placing more pressure on prices.

The most recent data suggests their work to control prices has not yet been fully effective. However, they do run the risk of pushing the economy into a deep recession if they go too high and too far with interest rates. It can take several months before an increase can be assessed as effective, given that the last ten meetings of the MPC have resulted in a rise, they do not yet know whether these have helped sufficiently to dull consumer demand. Jerome Powell warned a committee of politicians in the US that rates will go higher than the market expects, prompting all US indices to retreat because of his words. In many respects, this sums up the responsibility and influence of the central bank policymakers. Not only do they have to navigate difficult decisions, but much of our financial future rests on their judgement.

The value of seeking guidance and advice

It is important to seek advice and guidance from a professional financial adviser who can help to explain how to build an appropriate financial plan to match your time horizons, financial ambitions, and risk comfort. If you already have a plan in place, or have already invested, it is important to allocate time to review this to ensure this remains on track and appropriate for your needs.

Investing can feel complex and overwhelming, but our educational insights can help you cut through the noise. Learn more about the Principles of Investing here.

Note: Data as at 7 March 2023. 1Federal Reserve, 7 March 2023. 2CBS19 News, 7 March 2023. 3Federalreservehistroy.org, 7 March 2023. 4Bank of England, 7 March 2023.

Important information

For retail distribution.

This document has been approved and issued by Santander Asset Management UK Limited (SAM UK). This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Opinions expressed within this document, if any, are current opinions as of the date stated and do not constitute investment or any other advice; the views are subject to change and do not necessarily reflect the views of Santander Asset Management as a whole or any part thereof. While we try and take every care over the information in this document, we cannot accept any responsibility for mistakes and missing information that may be presented.

The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Past performance is not a guide to future performance.

All information is sourced, issued, and approved by Santander Asset Management UK Limited (Company Registration No. SC106669). Registered in Scotland at 287 St Vincent Street, Glasgow G2 5NB, United Kingdom. Authorised and regulated by the FCA. FCA registered number 122491. You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/register.

Santander and the flame logo are registered trademarks.www.santanderassetmanagement.co.uk