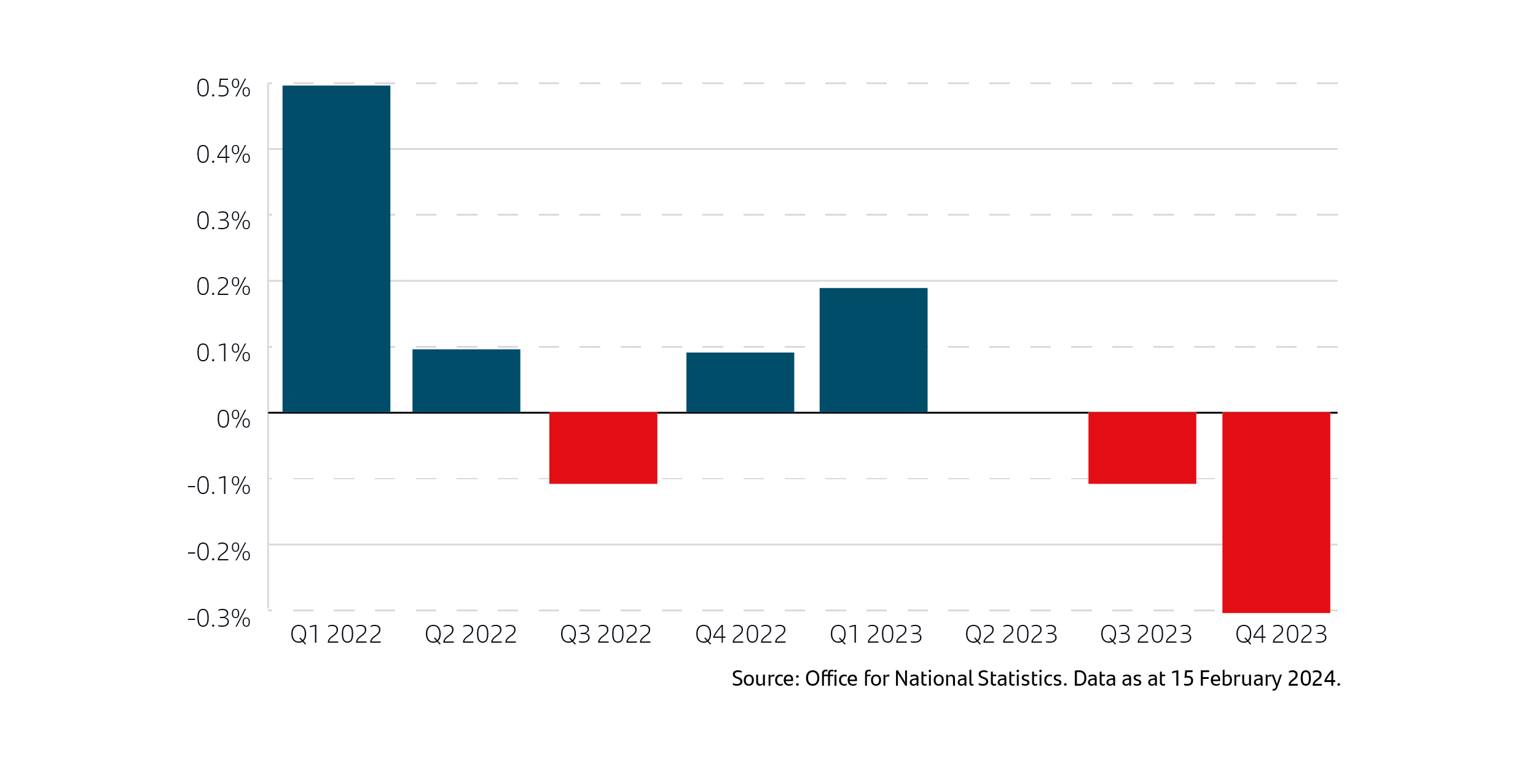

Last week, the Office for National Statistics (ONS) published the latest UK Gross Domestic Product (GDP) figures for the final three months of 2023, which fell 0.3%.1 As this followed a 0.1% fall1 in the previous quarter, the UK has entered into a technical recession, commonly defined as two consecutive quarters of negative growth. What was the reason for the negative growth? Is it likely to continue? Santander Asset Management UK share their insights in this week’s State of Play.

Gross Domestic Product (GDP)

What is GDP?

GDP is a measurement that seeks to capture a country’s economic output. Countries with larger GDPs will have a greater amount of goods and services generated within them and will generally have a higher standard of living. For this reason, many citizens and political leaders see GDP growth as an important measure of national success, often referring to GDP growth and economic growth interchangeably.2

Why is it important?

GDP is an important measurement for economists and investors because it tracks changes in the size of the entire economy. In addition to serving as a comprehensive measure of economic health, GDP reports can provide insights into the factors driving economic growth or holding it back.3

Recession

A recession is a meaningful and extensive downturn in economic activity. A common definition of a recession is two consecutive quarters of negative growth in a country’s GDP. In general, recessions bring decreased economic output, lower consumer demand, and higher unemployment.3

Recessions can vary by length and impact. 2020 saw a relatively short recession due to the impact of global lockdowns as a result of COVID-19. The economy shrank by 2.9% in the first quarter of 2020, when the pandemic first spread to the UK, before a record 19% fall in the subsequent quarter during the spring lockdown.4 The economy then grew at a record 16.1% in the third quarter. The 2008 and 2009 recession caused by the US subprime mortgage crisis saw five quarters of negative growth.

What’s caused the UK recession?

Liz McKeown, ONS director of economic statistics, said in a recent statement: ‘All the main sectors fell on the quarter, with manufacturing, construction and wholesale being the biggest drags on growth, partially offset by increases in hotels and rentals of vehicles and machinery.’5

GDP quarterly estimates

According to ONS estimates, UK GDP grew by 0.1% in 2023. If 2020—when the pandemic hit the economy—is not included, that represents the weakest performance since 2009, when we were still in the throes of the global financial crisis. The little increase in GDP last year came after 4.3% growth in 2022.5 This will be unwelcome news for Rishi Sunak and the Conservative government, which made growing the economy a key part of the Conservative Party platform and face an election later in the year.

The Chancellor of the Exchequer, Jeremy Hunt, believes that high inflation has been the main cause of negative growth as it has forced the Bank of England (BoE) to raise interest rates.6 Higher interest rates increase the cost of mortgages and loans and means consumers have less money in their pockets to spend.

How long will this recession last?

While some previous recessions, like the one that occurred during the global financial crash of 2008 and 2009, were quite severe and long lasting, we anticipate this one will most likely be fairly mild and pass quickly.

GDP growth has been weak throughout 2023, and although we have had two quarters of negative growth, this could be seen as a continuation of growth stagnation. The data released by the ONS is in line with the relative weakness observed in confidence indicators, a statistical indicator based on the results from business surveys interrogating enterprises on their current economic situation and their expectations about future developments. The accuracy of these indicators could be good news, as they are now pointing to some reacceleration of GDP growth in the UK at the beginning of 2024.7 However, if this proves to be true, we believe it is likely to be at relatively low levels.

Usually, during a recession, unemployment tends to reach higher levels. However, the UK unemployment rate (3.8%) for those aged 16 years and over, decreased in the latest quarter.8 Annual growth in employees' average regular earnings (excluding bonuses) was 6.2%.6 This data shows that the labour market in the UK is currently very strong and is not being impacted by the current stagnation of economic growth.

How are others faring?

The UK is not alone, Japan has also entered into a technical recession with two consecutive quarters of negative growth. It has been reported that Germany is also likely to be in a recession as external demand is weak, consumers remain cautious and domestic investment is held back by high borrowing costs.9 The Eurozone narrowly avoided entering a technical recession, with GDP neither growing nor declining in the previous quarter. In the US, the complete opposite is happening. The country's economy grew by far more than predicted in the last two quarters, primarily as a result of strong consumer spending.10

The value of seeking guidance and advice

It is important to seek advice and guidance from a professional financial adviser who can help to explain how to build an appropriate financial plan to match your time horizons, financial ambitions and risk comfort. If you already have a plan in place or have already invested, it is important to allocate time to review this to ensure this remains on track and appropriate for your needs.

Investing can feel complex and overwhelming, but our educational insights can help you cut through the noise. Learn more about the Principles of Investing here.

Note: Data as at 22 February 2024. 1Office for National Statistics, 15 February 2024, 2Investopedia, 29 November 2023, 3Investopedia, 17 December 2023, 4The Guardian, 12 February 2021, 5CNN Business, 15 February 2024, 6Sky News, 15 February 2024, 7Santander Asset Management Global, 19 February 2024, 8Office for National Statistics, 13 February 2024, 9Investing.com, 19 February 2023, 10CNN Business, 16 February 2023.

Important information

For retail distribution.

This document has been approved and issued by Santander Asset Management UK Limited (SAM UK). This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Opinions expressed within this document, if any, are current opinions as of the date stated and do not constitute investment or any other advice; the views are subject to change and do not necessarily reflect the views of Santander Asset Management as a whole or any part thereof. While we try and take every care over the information in this document, we cannot accept any responsibility for mistakes and missing information that may be presented.

The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Past performance is not a guide to future performance.

All information is sourced, issued, and approved by Santander Asset Management UK Limited (Company Registration No. SC106669). Registered in Scotland at 287 St Vincent Street, Glasgow G2 5NB, United Kingdom. Authorised and regulated by the FCA. FCA registered number 122491. You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/register.

Santander and the flame logo are registered trademarks.www.santanderassetmanagement.co.uk