Last week was a turbulent week for financial markets, with investors beginning to worry that the US economy could be falling towards a recession. A disappointing US jobs report caused the initial sell-off as the rise in unemployment breached a well-regarded recession indicator based on labour market conditions. This week’s State of Play looks at what happened and our thoughts going forward.

US labour report

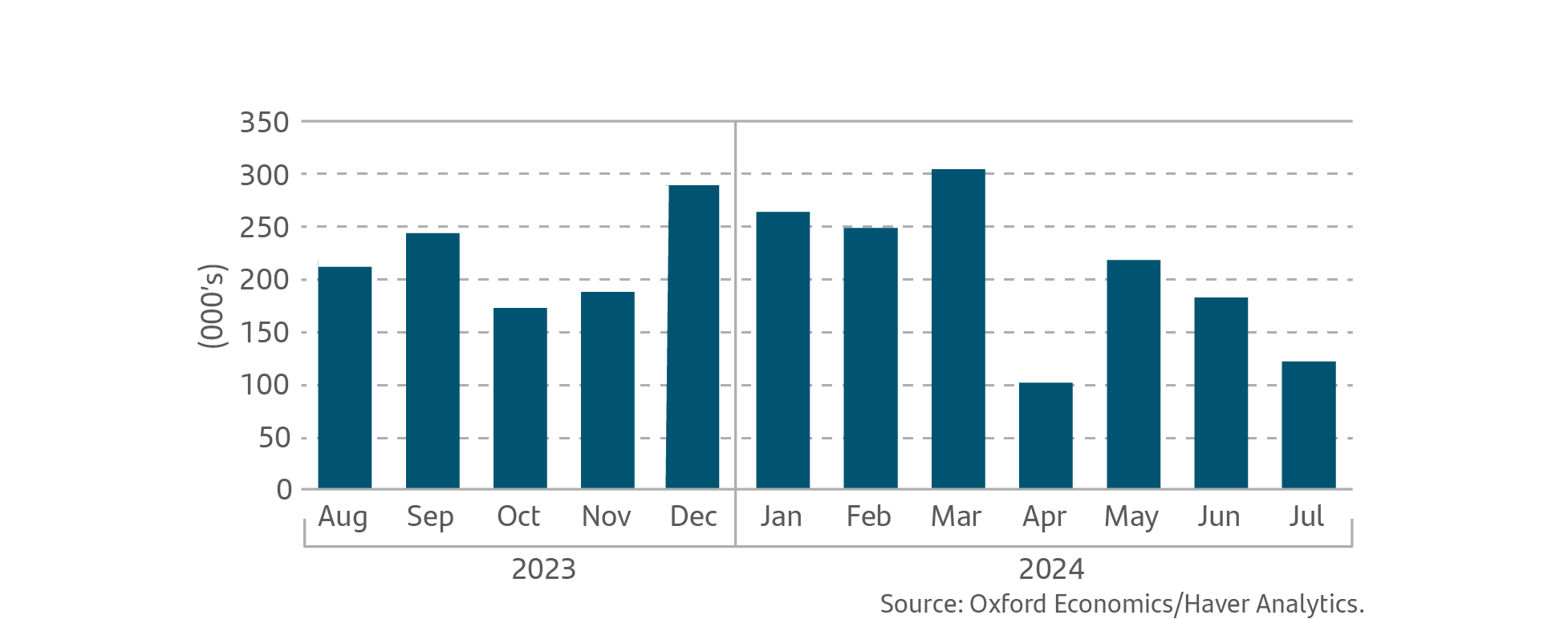

US nonfarm payrolls rose 114,000 in July, well below the consensus estimate of an increase of 175,000.1 This reading followed the 179,000 increase (revised from 206,000) recorded in June. Other details of the report showed that the US unemployment rate climbed to 4.3% from 4.1% in June and annual wage inflation, as measured by the change in the average hourly earnings, declined to 3.6% from 3.8% in the same period.2

US: Nonfarm payroll employment

Nonfarm payroll refers to the number of workers in the US except those who work in farming, private households, non-profits, and sole proprietorships or self-employment, as well as those who are active military service members. It represents roughly 80% of all workers who contribute to gross domestic product.3

The Sahm Rule

Global investors reacted to the news with fears that the US economy could be heading for a recession, leading to a sell-off in global stock markets. This prompted investors to turn to one of the most time-tested indicators to determine whether the US economy is in a recession, the Sahm Rule.

This is when the three-month moving average of the US unemployment rate is at least half a percentage point higher than the 12-month low, which is believed to indicate the initial phase of a recession. The weaker-than-expected July jobs report on Friday officially triggered this rule and prompted investors to worry that the US Federal Reserve (Fed) could be behind the curve in cutting interest rates, which helps fend off a recession.

However, the rule’s inventor, Claudia Sahm, is not convinced: ‘We are not in a recession now — contrary to the historical signal from the Sahm rule — but the momentum is in that direction. A recession is not inevitable and there is substantial scope to reduce interest rates.’4

Japan

Japanese markets also contributed to last week’s market volatility. Rising interest rates in Japan, while the rest of the world is cutting interest rates, has hindered a popular trade that has seen investors borrow cheaply in yen to invest in higher yielding places like Mexico. The undoing of that trade has pushed the yen higher, which is bad news for an export-focused market like Japan.

IA

Also contributing to the market volatility last week were concerns on the sustainability of Artificial Intelligence (AI) focused share prices that have been a major contributor to the recent rises in the US market. Well-renown investor Warren Buffet announced last week that Berkshire Hathaway sold half of its Apple shares. This came as a shock to some investors and increased the volatility in AI shares further. Despite the sale, Apple shares remain Berkshire Hathaway’s largest holding.5

Global markets

Things feel calmer than they did a week ago, as the major global indexes have recovered from the biggest sell-off in nearly two years. The varying factors culminated in a sharp decline and subsequent recovery in Japan, accompanied by more subdued movements in other markets. A large portion of the damage had been fixed by the end of the week.

Our outlook

Despite some moderation in US economic growth, which is to be expected, we believe that the underlying fundamentals remain solid and point to the US growing around 1.5% to 2.0% in GDP.

Payroll data tends to be volatile, we expect this to get back around the 150,000 mark in the coming months. We expect that the Fed will start reducing interest rates in September, and given recent developments, we do not rule out cuts of up to -0.75% in 2024.

We believe that the market reaction has been extreme, and it is important to bear in mind that shares were gaining strongly year-to-date. In our view, and with a medium-long term view, we believe that the environment is positive for shares. We will continue to follow these events closely and look for investment opportunities.

In the scenario where things may seem uncertain, leading to episodes of high volatility such as the current one, it is important to remember that the best tools at our disposal are diversification, an appropriate risk profile and maintaining the time horizon of investments.

The value of seeking guidance and advice

It is important to seek advice and guidance from a professional financial adviser who can help to explain how to build an appropriate financial plan to match your time horizons, financial ambitions and risk comfort. If you already have a plan in place or have already invested, it is important to allocate time to review this to ensure this remains on track and appropriate for your needs.

Investing can feel complex and overwhelming, but our educational insights can help you cut through the noise. Learn more about the Principles of Investing here.

Note: Data as at 15 August 2024. 1Oxford Economics, 12 August 2024. 2FX Street, 08 August 2024. 3Investopedia, 12 August 2024. 4CNBC, 5 August 2024. 5The Motley Fool, 10 August 2024

Important information

For retail distribution.

This document has been approved and issued by Santander Asset Management UK Limited (SAM UK). This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Opinions expressed within this document, if any, are current opinions as of the date stated and do not constitute investment or any other advice; the views are subject to change and do not necessarily reflect the views of Santander Asset Management as a whole or any part thereof. While we try and take every care over the information in this document, we cannot accept any responsibility for mistakes and missing information that may be presented.

The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Past performance is not a guide to future performance.

All information is sourced, issued, and approved by Santander Asset Management UK Limited (Company Registration No. SC106669). Registered in Scotland at 287 St Vincent Street, Glasgow G2 5NB, United Kingdom. Authorised and regulated by the FCA. FCA registered number 122491. You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/register.

Santander and the flame logo are registered trademarks.www.santanderassetmanagement.co.uk