The battle to tame rising prices is a complex one that policymakers must navigate carefully to avoid unintended consequences. Ever since the global financial crisis, mortgage borrowers have experienced a golden period of historically low interest rates, resulting in much lower monthly payments. The return of inflation and the response from central banks has brought this favourable environment to an abrupt end. When the Bank of England met this week to decide whether to increase interest rates, did they have one eye on the mortgage market? What does their decision mean for savers and investors? Simon Durling from Santander Asset Management shares his thoughts in this week’s State of Play.

Key highlights from this week’s State of Play

- Safe as houses?

- Latest UK inflation data

- MPC interest rate decision

- Market update

Safe as houses?

When the global financial crisis forced central banks to cut rates to near zero, mortgage rates plummeted. This prompted a golden period in which borrowers benefited from ultra-low rates, fuelling a buy-to-let boom and pushing up house prices even further.1 After the pandemic, much higher sustained inflation triggered a rapid normalisation of interest rates as central banks tried to tame inflation back to their long-term target of 2%. Rising interest rates is designed to remove disposable income from consumers to cool the economy, which in turn reduces demand and thus rising prices. Therefore, the intent of policymakers is to make borrowing more expensive for both consumers and businesses, so they spend less on goods and services. So far, the impact on mortgage borrowers is mixed. Why is this the case? Importantly, why does this matter to investors and savers?

Firstly, the mortgage market has borrowers who borrow at different times, depending on when they are moving home or re-mortgaging. Many have opted to fix their mortgage rate to provide peace of mind and more certainty in their household budgets. Fixed rates can be taken over different time periods, with borrowers often swayed by what they think may happen with interest rates in the future. What this means is that when the Bank of England decides to increase interest rates, it only affects a small proportion of borrowers initially with higher monthly payments (normally those stuck on variable or discounted rates linked to the base rate), but it does affect the mortgage deals available for new borrowers or those needing to re-mortgage. Those who chose to fix their mortgage keep the same monthly repayment and only need to worry about rates when their fixed-rate mortgage ends.

5-year UK swap rates

However, between now and the end of next year, 2.4 million borrowers will see their fixed-rate end and will be searching for a new rate, according UK Finance and the Bank of England.2 For the majority this represents a significant jump in their monthly payments directly affecting affordability and damaging their disposable income. Many of you may be asking how the fixed-rate mortgage market actually works and why this would have any impact on the outlook for investors?

So, let’s tackle the fixed-rate mortgage market question first. Many of the mortgage deals you may see advertised on comparison sites or directly from the specific lender tend to centre around what is called a ‘swap rate’.

Swap rates explained

Swap rates are when two financial organisations (banks normally) swap interest rate payments with one another. One bank agrees to receive a fixed-rate payment, while the other receives a variable payment. In the case of mortgages, it is what lenders pay to financial institutions to acquire fixed funding for a specified term to create a mortgage product for the end borrower. They can have various timeframes, typically two, three, five and 10-year terms, and the cost is used to price mortgage products for lenders. As swap rates are based on what the markets think interest rates will be in the future, if they rise, mortgage lenders will increase their pricing to maintain their profit margin, or if they rise too rapidly then they may have to pause lending or withdraw products until pricing stabilises, like we saw in the mini-budget crisis last autumn or more recently in the last few weeks.3

What is the importance of the mortage market?

The reason State of Play this week is exploring the latest mortgage market concerns is the knock-on affect on a combination of factors which could feed into investment markets. In its bid to tackle inflation, the Bank of England uses rate rises as its primary weapon. Increased borrowing costs reduces economic consumption and potentially brings down price rises. However, policymakers are mindful that rate rises are a blunt instrument that takes time to impact, as I mentioned at the start of this update. The expectations of future direction for interest rates feeds first into bond yields and then into how share prices are valued. Also, the mortgage market is an important influence for the bank, in part because homeowners with mortgages are a fundamental element of the UK economy and housing market. If mortgage borrowers fall on hard times due to large increases in their borrowing costs, eventually this will feed into consumer demand. The other measure that is fundamental to the policy committee’s objectives under the bank’s remit is to maintain stable prices. So, what is the latest UK inflation data that will weigh on their decision on Thursday?

Latest UK inflation data

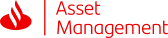

The Monetary Policy Committee is faced with a tough set of circumstances. According to the Office for National Statistics (ONS) Consumer Price Inflation (CPI) remained unchanged in the 12 months to the end of May at 8.7%, well above the expected fall to 8.4%.4 Far more worrying to policymakers will be the unexpected rise in core inflation from 6.8% to 7.1%, the highest since March 1992.4 The ONS latest report explains the key drivers for inflation – ‘Prices for recreational and cultural goods and services rose, overall, by 6.8% in the year to May 2023, up from 6.4% in April, and the highest rate since August 1991.4 The increase in the annual rate between April and May 2023 was the result of small upward effects from a variety of the more detailed classes. The largest came from cultural services (particularly admission fees to live music events); games, toys, and hobbies (particularly computer games); and package holidays. Short-term movements in live music fees and computer game prices should be interpreted with a degree of caution as these movements depend upon the acts that are touring and the composition of bestseller charts respectively.4 Food and non-alcoholic beverage prices rose by 18.4% in the year to May 2023, down from 19.1% in April and from 19.2% in March, which was the highest annual rate seen for over 45 years.4 The latest easing in the annual rate reflects a monthly rise of 0.9% between April and May 2023, compared with a larger 1.5% increase between the same two months a year ago.’

Contributions to change in the annual CPI inflation rate, UK, between April and May 2023

Bank of England interest rate decision

The Monetary Policy Committee (MPC) of the Bank of England met to make the key decision on how much to increase interest rates. Faced with stubbornly high inflation data from Wednesday’s ONS release, high wage settlements and a resilient economy, the nine-member committee decided to increase the base rate by 0.5% as opposed to the 0.25% that was forecasted.5 Two members voted to keep rates unchanged, while the other seven voted for an increase.6 The rates are now at 5%, the highest since September 2008. Clearly, faced with core inflation rising, rather than falling, the policymakers had little choice than to act. Their focus will no doubt turn to how their decision feeds into the market reaction and the subsequent future impact on the UK economy. The rapid normalisation of interest rates whilst unprecedented in modern times, takes time to take effect and the risk remains that rises could go further than is necessary to tame rising prices and subsequently tip the economy into recession. Those with mortgages, especially with a fixed rate due to finish in the next 18 months, will be keeping their fingers crossed that the future for interest rate expectations finally reaches their peak, so they can turn their attention to the point in the future when inflation falls and the MPC can start the debate about when it will be the right time to start cutting rates rather than increasing them.

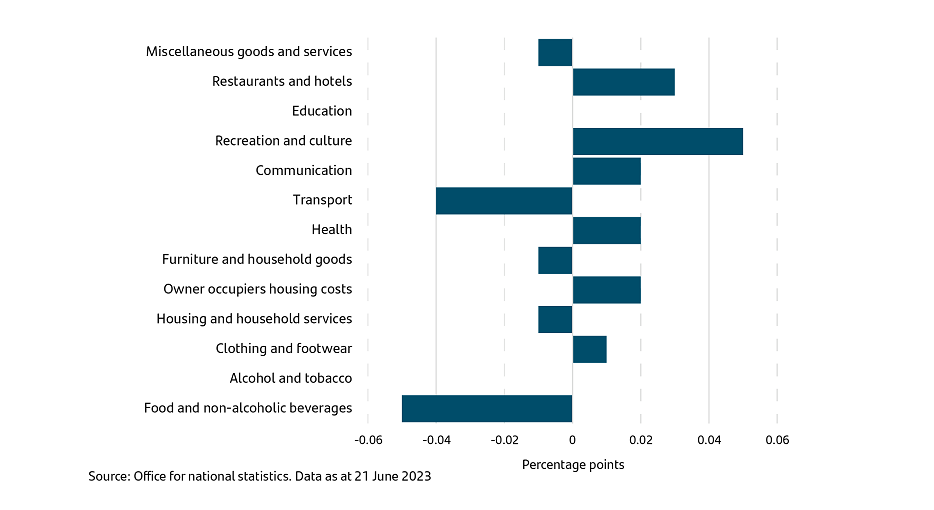

Market Update

As we approach the halfway stage of the year, last week the US stock market had its best week since March as more investors appeared to be drawn in by a rising market after being hesitant earlier in the year with so much uncertainty surrounding inflation and rising interest rates. The technology orientated NASDAQ index increased by 3.8%, with the wider market index S&P 500 rising by 2.6%.7 In addition to the bullish week in the US, Japan’s stock market performed even better, building on the very positive year thus far. The most familiar Japanese index, the Nikkei 225 rose 4.5% for the week to top the charts and is now up 30% year to date.7 While markets started very muted this week, last week reminded us about the perils of trying to time investing. Investing is about time and patience centred around an appropriate portfolio aligned to your risk comfort, time horizon and objectives.

Te value of seeking guidance and advice

It is important to seek advice and guidance from a professional financial adviser who can help to explain how to build an appropriate financial plan to match your time horizons, financial ambitions, and risk comfort. If you already have a plan in place, or have already invested, it is important to allocate time to review this to ensure this remains on track and appropriate for your needs.

Performance

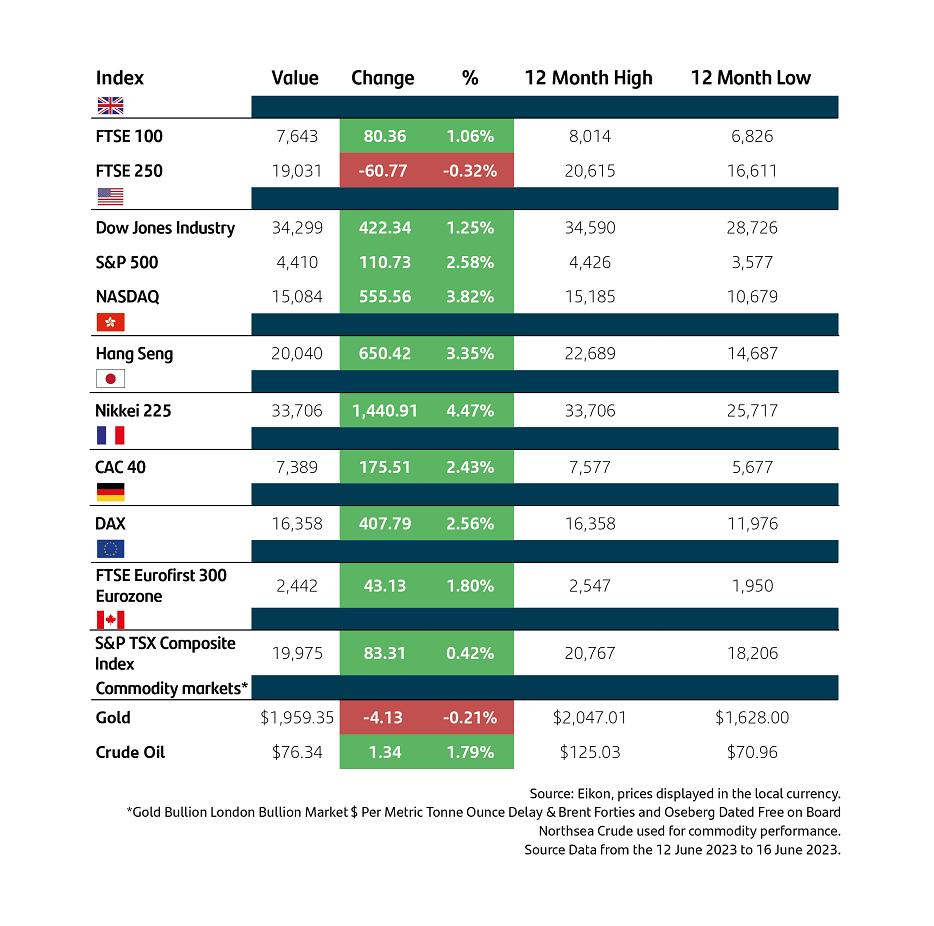

10-year bond yields

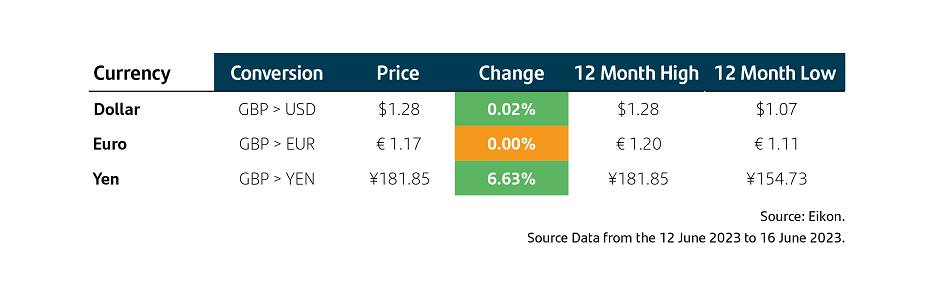

Currencies

Investing can feel complex and overwhelming, but our educational insights can help you cut through the noise. Learn more about the Principles of Investing here.

Note: Data as at 23 June 2023. 1Cashfloat, 19 February 2023. 2BBC 19 June 2023. 3PIMCO, 21 June 2023. 4Office for National Statictics (ONS), 21 June 23. 5Bank of England, 22 June 2023. 6Investing.com, 22 June 2023. 7Eikon, 21 June 2023.

Important information

For retail distribution.

This document has been approved and issued by Santander Asset Management UK Limited (SAM UK). This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Opinions expressed within this document, if any, are current opinions as of the date stated and do not constitute investment or any other advice; the views are subject to change and do not necessarily reflect the views of Santander Asset Management as a whole or any part thereof. While we try and take every care over the information in this document, we cannot accept any responsibility for mistakes and missing information that may be presented.

The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Past performance is not a guide to future performance.

All information is sourced, issued, and approved by Santander Asset Management UK Limited (Company Registration No. SC106669). Registered in Scotland at 287 St Vincent Street, Glasgow G2 5NB, United Kingdom. Authorised and regulated by the FCA. FCA registered number 122491. You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/register.

Santander and the flame logo are registered trademarks.www.santanderassetmanagement.co.uk