Q1 2024

This publication aims to provide an insight into the changing economic environment and importantly, how this has impacted financial markets and investments. Our Multi-Asset Solutions team at Santander Asset Management UK share their thoughts on the market outlook and how they have adapted investment portfolios to position our clients for the road ahead.

Summary of Quarterly Perspectives content:

- Review of the first quarter of 2024

- Investment performance of different asset classes year to date

- Our expert’s opinion on the investment outlook

- How have our multi-asset fund managers changed their portfolio positioning based on the outlook and our tactical asset allocation

- Summary of the quarterly perspectives

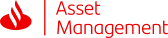

Outlook at a glance

Reviewing the first quarter of the year

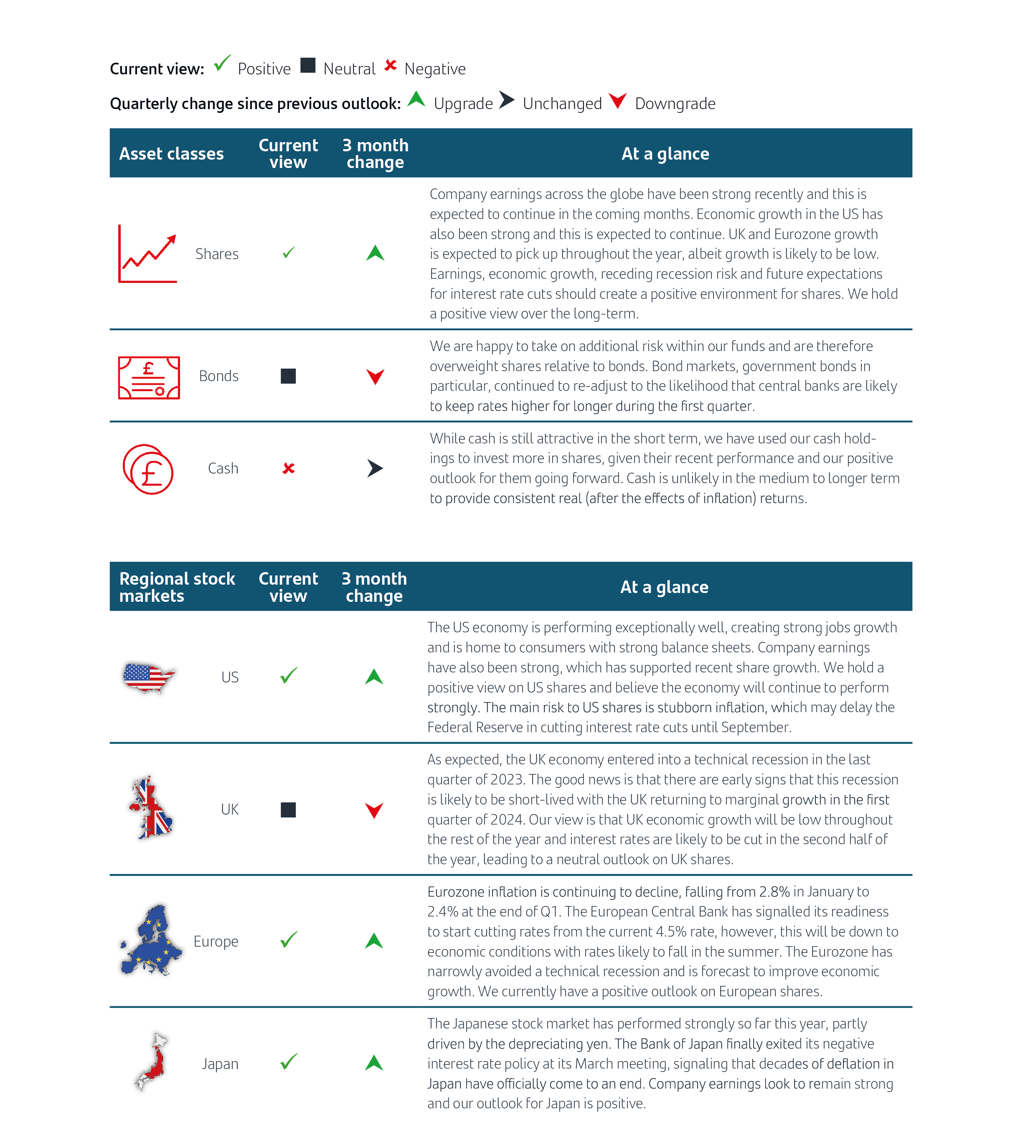

The first quarter of 2024 proved to be a good one for investors in shares.1 The rally in global markets that had taken off in the final quarter of last year continued, boosted by growing hopes that the world’s major central banks would begin to cut interest rates in 2024.2 Positive company earnings growth across many regions and sectors – particularly in large US technology companies such as artificial intelligence-related semiconductor producer Nvidia3 – also helped to drive shares higher. Additionally, modest falls in inflation456 supported investor sentiment, although central bank officials cautioned that inflation still remained a little too high for comfort.7

Several major share indices, including the S&P 500 (US)8, the Dax (Germany)9 and the Nikkei (Japan)10, established new all-time highs during the period.

The UK share market lagged, rising only mildly.11 Developed world markets outperformed those in emerging markets, with Chinese shares once again the culprit, falling13 due to subdued economic growth and the significant problems in its property sector.14

Despite the generally upbeat mood among investors, there was some disappointment that major central banks, most notably the US Federal Reserve (Fed), appeared to push back the timing of interest-rate cuts. At the start of the year, expectations were high that the Fed would start to reduce rates by March.15 However, the resilience of the US economy, especially strong labour-market data16, meant that the Fed was wary of lowering rates too soon.17

While US economic data remained robust, it was decidedly mixed elsewhere. The eurozone and Japanese19 economies barely grew, while the UK fell into a technical recession20 after the economy fell 0.3% on a quarterly basis in the final quarter of 2023, following a decline of 0.1% in the third quarter.

After a dramatic rally in the final quarter of 2023, returns from global bond markets were disappointing.21 They fell mildly over the period, largely because of the Fed’s reticence to move too quickly on rate cuts22 – a stance that was imitated by the Bank of England23 and the European Central Bank.24

1st quarter asset class performance

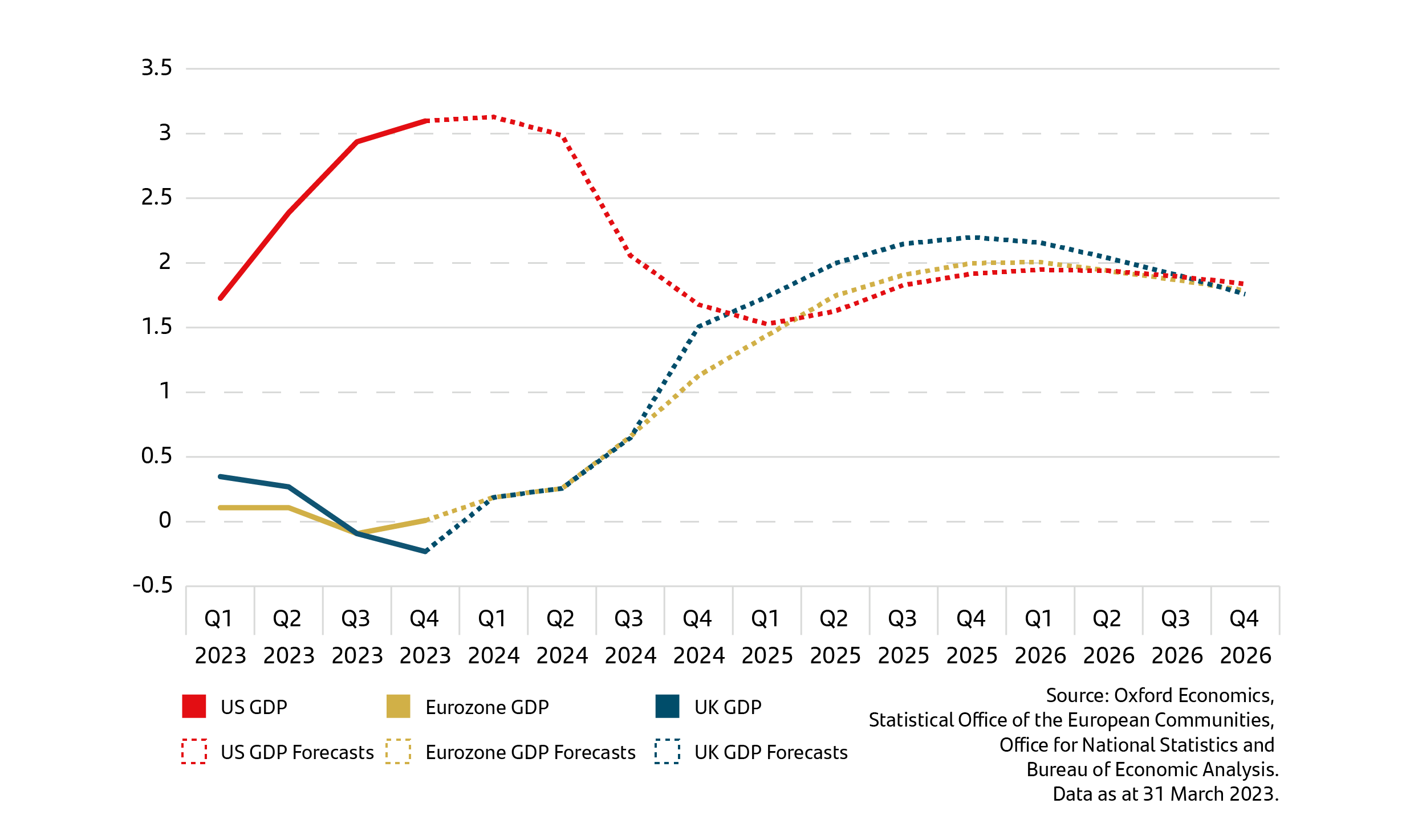

Gross Domestic Product (GDP)

GDP is a measurement that seeks to capture a country’s economic output. Countries with larger GDPs will have a greater amount of goods and services generated within them and will generally have a higher standard of living.

For this reason, many citizens and political leaders see GDP growth as an important measure of national success, often referring to GDP growth and economic growth interchangeably.

GDP is an important measurement for economists and investors because it tracks changes in the size of the entire economy. In addition to serving as a comprehensive measure of economic health, GDP reports can provide insights into the factors driving economic growth or holding it back.

GDP forecasts from Oxford Economics

GDP Outlook

The UK officially entered into a technical recession, commonly defined as two consecutive quarters of negative growth, in the final quarter of 2023. Although there are early signs that this recession is to be short-lived, the UK monthly GDP numbers for January and March have been positive and the UK is likely to return to marginal growth throughout the rest of 2024. Research from Oxford Economics shows that the UK is forecast to produce higher economic growth throughout 2025 and 2026, although their expectations are more optimistic than the ‘modest’ predictions from the International Monetary Fund, who expect UK GDP to grow 0.7% throughout 2024 and 1.2% throughout 2025.25 Nonetheless, the news that the UK is likely to be out of recession and expected to return to growth will be welcome for UK businesses and investors.

While countries around the world have struggled to recover from the economic setbacks brought on by the pandemic, the US has emerged particularly strong. The country's economy grew by far more than predicted in the last two quarters, primarily as a result of strong consumer spending.26 We believe that the US is likely to continue to deliver strong economic growth going forward.

The Eurozone narrowly escaped entering a technical recession, delivering flat GDP growth (0.00%) in the fourth quarter of 2024 after delivering -0.1% in the third quarter.27 Like the UK, the European Commission expects Eurozone GDP to grow 1.3% throughout 2024 and 1.7% throughout 2025 – slightly more modest than the predictions in the graph above.28

Inflation and interest rates

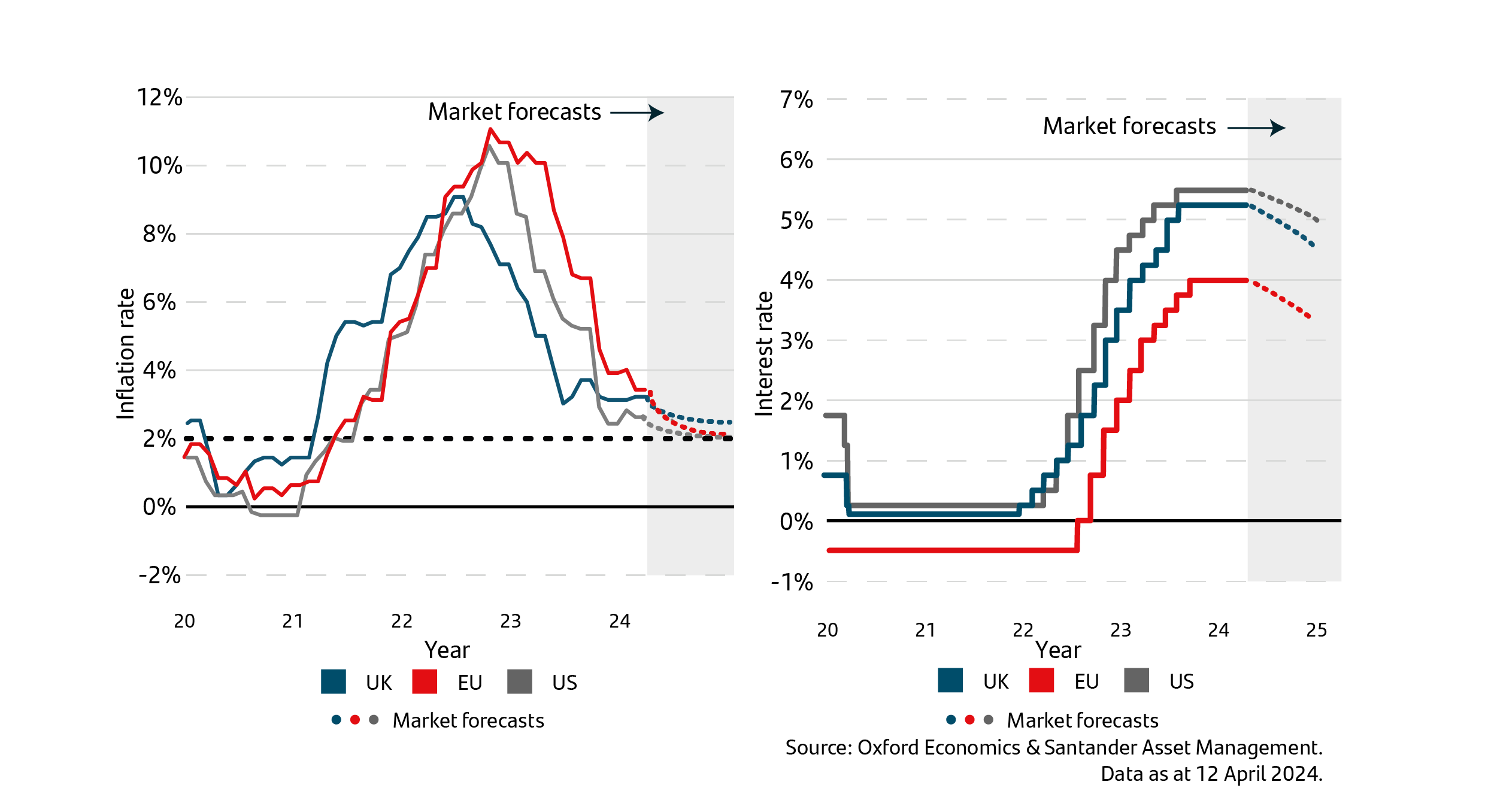

Inflation and interest rates have been dominating the financial news lately, and for good reason. Understanding these measures is crucial to making informed investment decisions, as they can help explain why your portfolio may be behaving in a certain way. The two charts below provide a view of historic and current trends in these areas, helping you to better understand what’s going on in the current economy.

Left: Headline inflation and consensus forecast. Right: Official interest rates and expectations

Inflation and interest rates outlook

When interest rates go up, it becomes more expensive to borrow money, which can lead to a decrease in consumer spending and economic growth. This can cause shares and bonds to lose value and make it harder for companies to generate profits, which can ultimately hurt your investment returns. However, rising interest rates can be a powerful tool for tackling inflation. The slowdown in spending helps to reduce the upward pressure on prices that contributes to inflation. While rising interest rates may have a negative impact, it can play an important role in keeping inflation in balance.

The US Federal Reserve (Fed), the Bank of England (BoE) and the European Central Bank (ECB) announced in their most recent meetings that they are making no changes to the current interest rates. Encouragingly, inflation has been falling and it is getting closer to the central bank’s target of 2%, meaning that it is close what they set out to achieve when raising interest rates. If inflation continues to fall, central banks will look to cut interest rates to ease the pressure on the economy.

The Fed maintained their previous forecast of three rate cuts in 2024 during their meeting in March and markets anticipated that their first interest rate cut was likely to come in their June meeting. Unfortunately for the Fed, data released in April showed that inflation in the US increased more than expected, leading to financial markets anticipating that the Fed would delay cutting interest rates until September.29 Unlike the UK and the Eurozone, the US economy is doing well due to high levels of consumer spending, which is causing what is known as sticky inflation, where inflation is struggling to come down further in the 'last mile'.

As the economies in the UK and Eurozone are currently facing stagnant growth, it is less likely that they will face the same issue as the US, and the inflation outlook for these economies is broadly positive. The UK is expected to reach its 2% inflation target in the first half of 2024, supported by favorable developments in food and energy prices.30 The Eurozone is expected to come close to its 2% target by the end of 2024. There are some risks to these forecasts, disruptions in the Red Sea are causing issues for global supply chains, and relatively strong wage growth could see inflation stay higher for longer. If inflation does continue to fall, it is expected that the ECB will cut interest rates in the summer. The BoE is yet to give an indication of when they are planning to cut rates, the market consensus is that they are also likely to cut in the summer, but it is expected to be slightly later than the ECB. One key point from the BoE’s most recent meeting was that it was the first time no members voted to raise interest rates since they started increasing, signaling a shift in the committee’s views.

Share outlook

Shares globally have continued to perform strongly in the first quarter of 2024 after a particularly strong end to 2023. US shares are worth pointing out as a standout performer, as US indices have performed very well. The US economy is continuing to perform well, companies are posting strong earnings growth and we expect that to continue throughout the next quarter of 2024. Economists are projecting double-digit earnings growth31 in the US and their economy is showing no signs of slowing down.

The exception to the particularly strong performance in shares has been the UK, with the FTSE 100 only growing slightly over the quarter. We believe this trend is likely to continue throughout the next quarter and hold a neutral view on UK shares.

Part of the reason for the strong performance in shares globally is because it has been clear where we are in the interest rate cycle and markets are expecting central banks to cut rates in the summer. If inflation springs some

surprises, like we have seen recently in the US, it may lead to delays in interest rate cuts, which could disrupt stock markets and trigger a setback. However, this scenario is likely to be more negative for bonds. As shares have performed so strongly over the last 6 months, they could take a breather and pull back slightly over the next quarter, but we still hold a positive view in the long- term.

Bond outlook

Currently, we are happy to take on additional risk within our funds and are therefore overweight shares relative to bonds. We still favour corporate debt over government debt due to the higher levels of compensation available.

Bond markets (government bonds in particular) continued to re-adjust to the likelihood that central banks are likely to keep rates higher for longer during the first quarter. Bond markets were arguably overly optimistic about the timing and cadence of rate cuts during the last quarter of 2023, when they rallied strongly. However, the robustness of the US economy has led the market to rethink and reprice the Fed’s pivot point, pushing it further into 2024 and leading to elevated bond yields in the first quarter of 2024. Our view is that central banks are on track to bring inflation down to within their target ranges in 2024 and any subsequent rate cuts will be positive for bond investors.

Baffled by bonds?

Visit our Basics on Bonds page for more information.

Our tactical asset allocation

Our tactical asset allocation represents our views on the financial markets based on the current market conditions and our own market outlook over the coming months. The below chart demonstrates how our current positioning is either underweight, overweight or neutral when compared to a funds benchmark. Generally, an underweight position means that we think a sector will perform worse than others, so we hold less of it. Holding an overweight position means that we think a sector will perform better, so we hold more of it. A Neutral position means that we think a sector will perform similarly to others, so we will hold a similar amount as the benchmark.

Summary

- Economic growth in the US is strong, whilst growth in the UK and Eurozone remains stagnant. However, growth is likely to pick up over the year for the UK and Eurozone.

- Inflation continues to fall, although, inflation in the US is proving sticky.

- Markets are expecting the BoE and ECB to make interest rate cuts in the summer, with the Fed forecast to make cuts in September.

- Shares have performed well so far this year and we have a positive view on shares going forward.

- We are happy to take on additional risk within our funds and are therefore overweight shares relative to bonds.

Learn more, visit our website here for more insights into financial markets.

Note: Data as at 17 April 2024. 1Financial Times, 28 March 2024. 2CNN, 20 March 2024. 3Reuters, 22 February 2024. 4Trading Economics, 31 March 2024. 5Trading Economics, 31 March 2024. 6Trading Economics, 31 March 2024. 7Associated Press News, 20 March 2024. 8CNBC, 28 March 2024. 9Deutsche Welle, 13 March 2024. 10Reuters, 29 March 2024. 11Reuters, 28 March 2024. 12MSCI, 31 March 2024. 13Reuters, 17 January 2024. 14International Banker, 18 January 2024. 15Reuters, 24 January 2024. 16Reuters, 9 March 2024. 17Financial Times, 27 March 2024. 18Trading Economics, 31 March 2024. 19Trading Economics, 31 March 2024. 20Trading Economics, 31 March. 21S&P Global Developed Sovereign Bond Index, 31 March 2024. 22CNBC, 28 March 2024. 23Financial Times, 28 March 2024. 24Financial Times, 20 March 2024. 25UK Parliment , 15 March 2024. 26CNN Business, 16 February 2023. 27Reuters, 14 February 2024. 28European Commission, 15 April 2024. 29Reuters, 10 April 2024. 30KPMG, 31 March 2024. 31Inderes, 9 April 2024

Important information

For retail distribution.

This document has been approved and issued by Santander Asset Management UK Limited.

This document is for information purposes only and does not constitute an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Opinions expressed within this document, if any, are current opinions as of the date stated and do not constitute investment or any other advice; the views are subject to change and do not necessarily reflect the views of Santander Asset Management as a whole or any part thereof. While we try and take every care over the information in this document, we cannot accept any responsibility for mistakes and missing information that may be presented.

The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Past performance is not a guide to future performance.

All information is sourced, issued and approved by Santander Asset Management UK Limited (Company Registration No. SC106669). Registered in Scotland at 287 St Vincent Street, Glasgow G2 5NB, United Kingdom. Authorised and regulated by the Financial Conduct Authority (FCA). FCA registered number 122491. You can check this on the Financial Services Register by visiting the FCA’s websitewww.fca.org.uk/register.

Santander and the flame logo are registered trademarks. www.santanderassetmanagement.co.uk